Are you looking for ways to better finance and manage your supplier-customer chain?

Use ediFactoring, electronic document interchange, with your factoring financing!

Have your receivables financed, managed, and insured through classical domestic or export factoring or use financing of your suppliers by means of reverse factoring on the basis of a confirmation of your commitments! All that can be done electronically via the eFactoring Internet platform, with the support of EDI, electronic document interchange made available thanks to our partnership with EDITEL, a leading international provider of electronic document interchange services.

The modern digital ediFactoring service offers an ideal solution for automated and efficient financing of your supplier-customer relations (Supply Chain Financing) because:

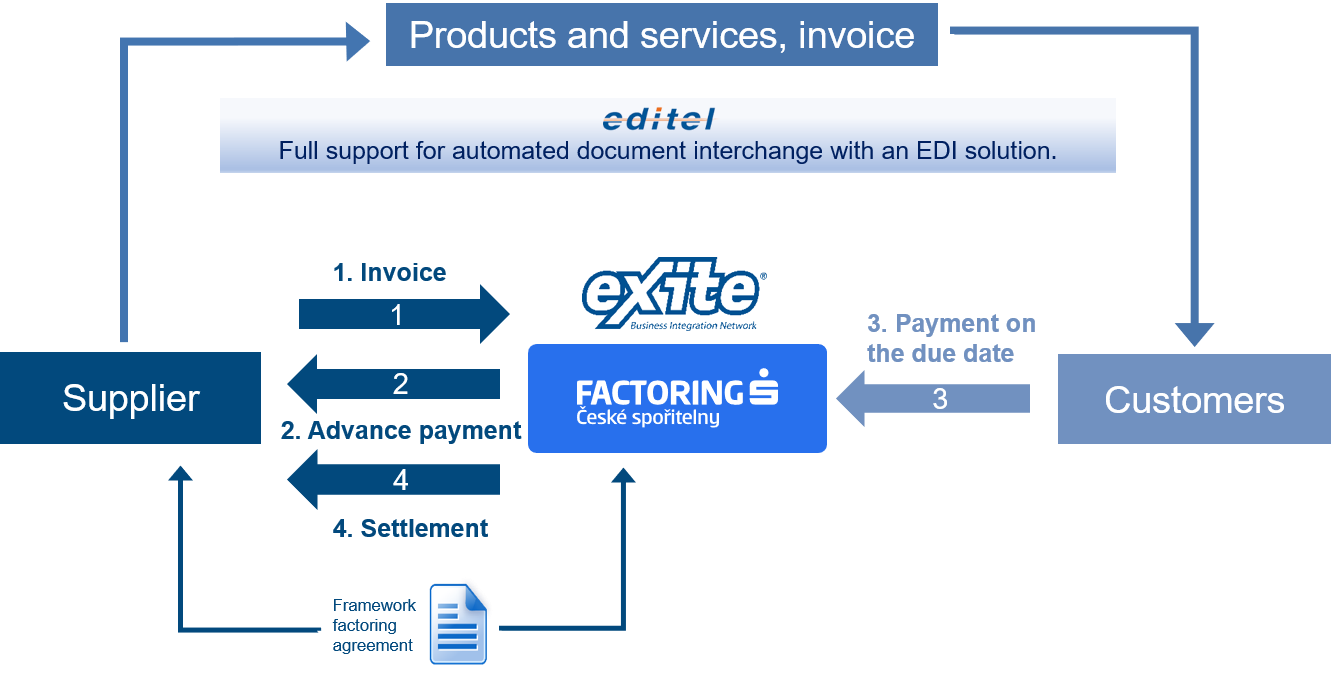

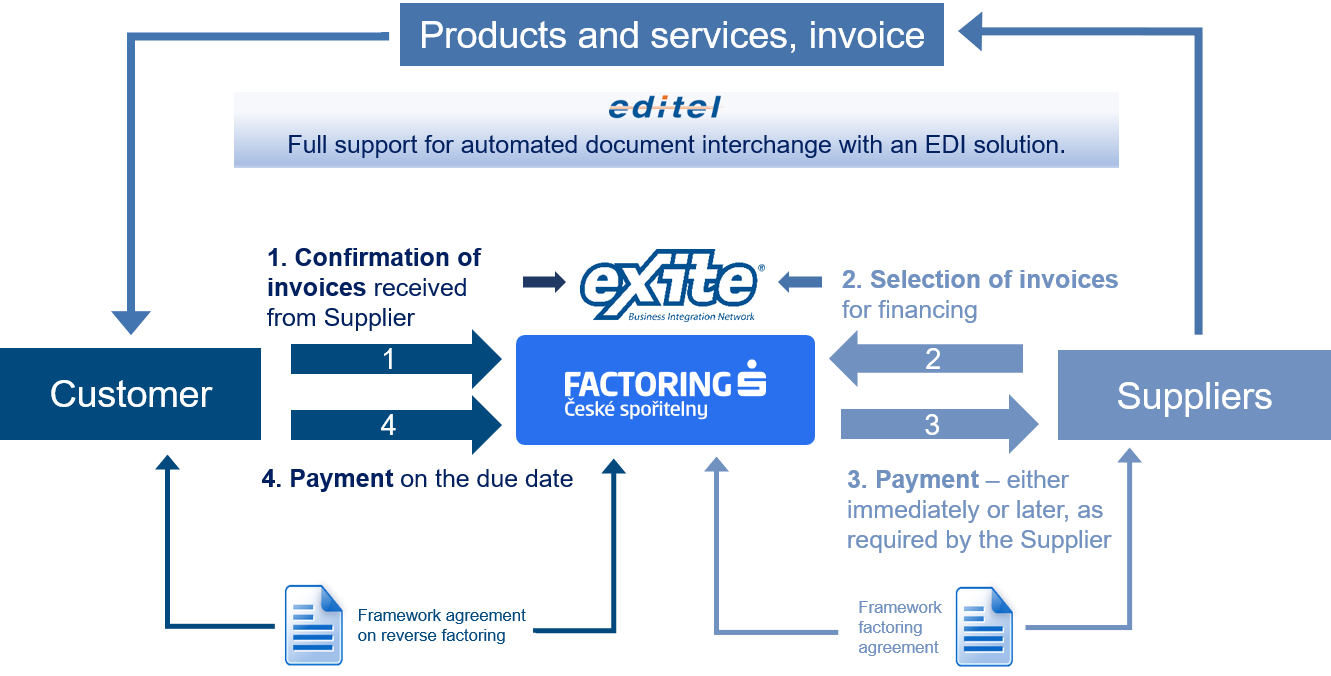

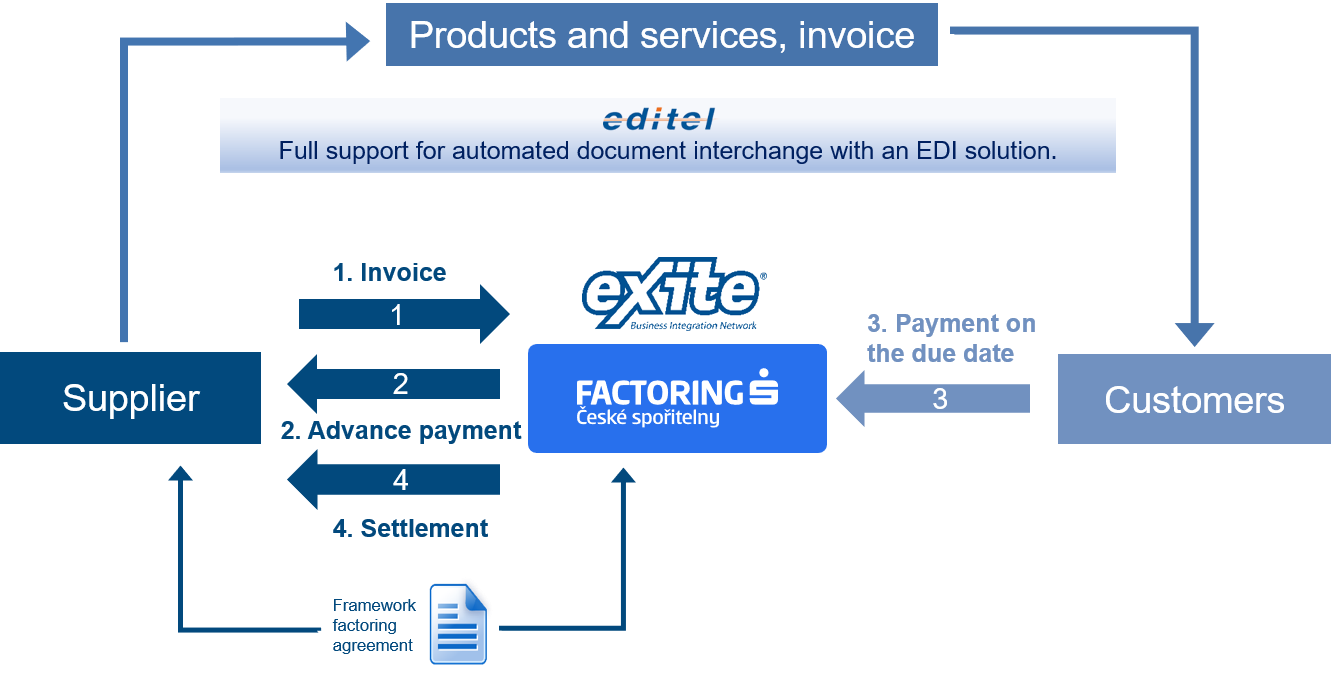

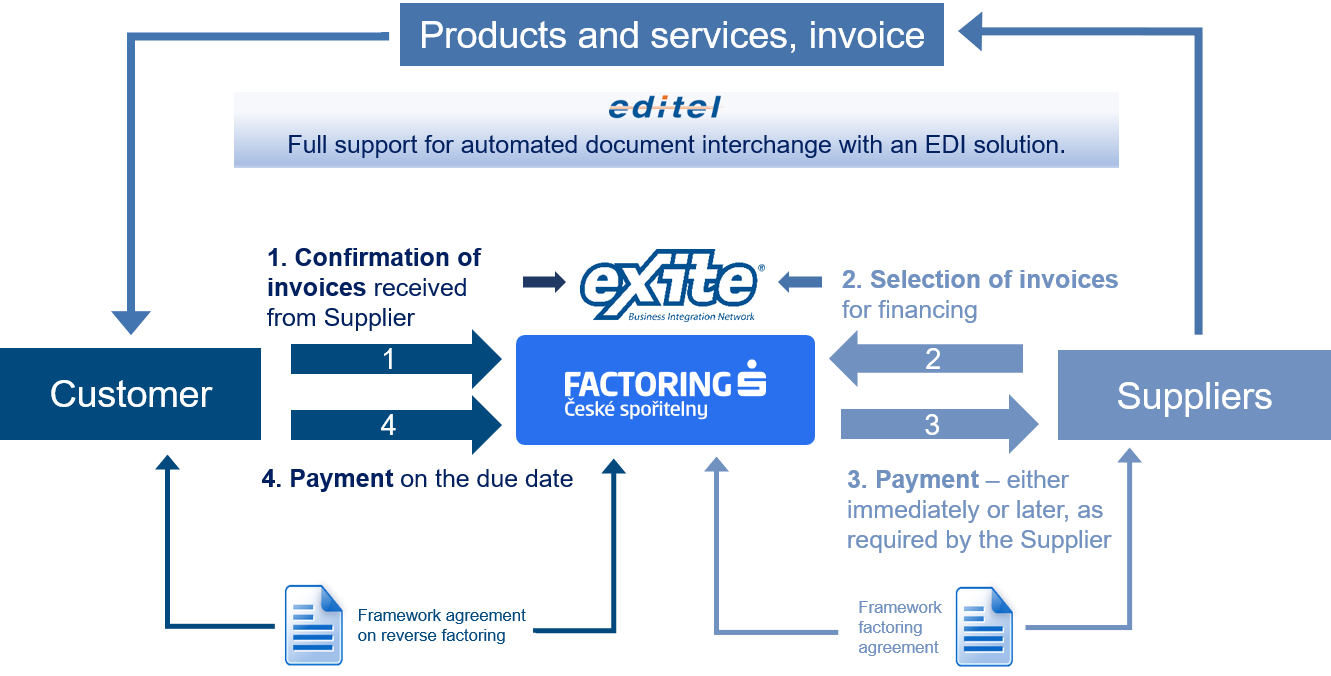

- with electronic data interchange between the supplier, Factoring České spořitelny, and the customer, work with documents (in particular, invoices and delivery documents) is automated and financing for your company or your suppliers is faster,

- you can use support in the form of EDI communication for classical as well as reverse factoring,

- the strategic partner of Factoring České spořitelny for the use of EDI is EDITEL.

Accelerating your financing

If you are using an EDI solution from EDITEL for electronic document interchange between you and your customers or suppliers, do not hesitate to approach us with a request for an offer of factoring financing. Electronic data interchange between you and us will help reduce your administrative burdens and accelerate the provision of financing to your company.

How does classical ediFactoring work?

How does reverse ediFactoring work?

Take advantage of factoring-based financing and combine it with the advantages of electronic document interchange (EDI). Cooperate with Factoring České spořitelny, a major player on the Czech factoring market.

Please contact us to request a customised offer.