Are you looking for ways to finance and better manage your supplier-customer chains?

Take advantage of your strong position in customer-supplier relations!

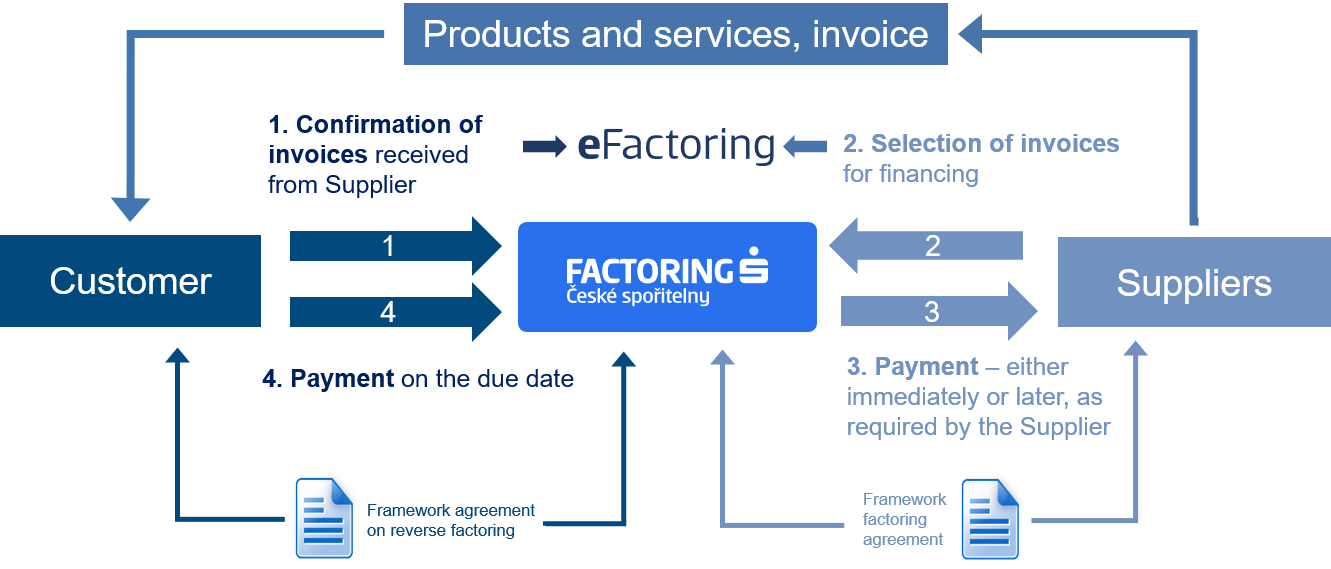

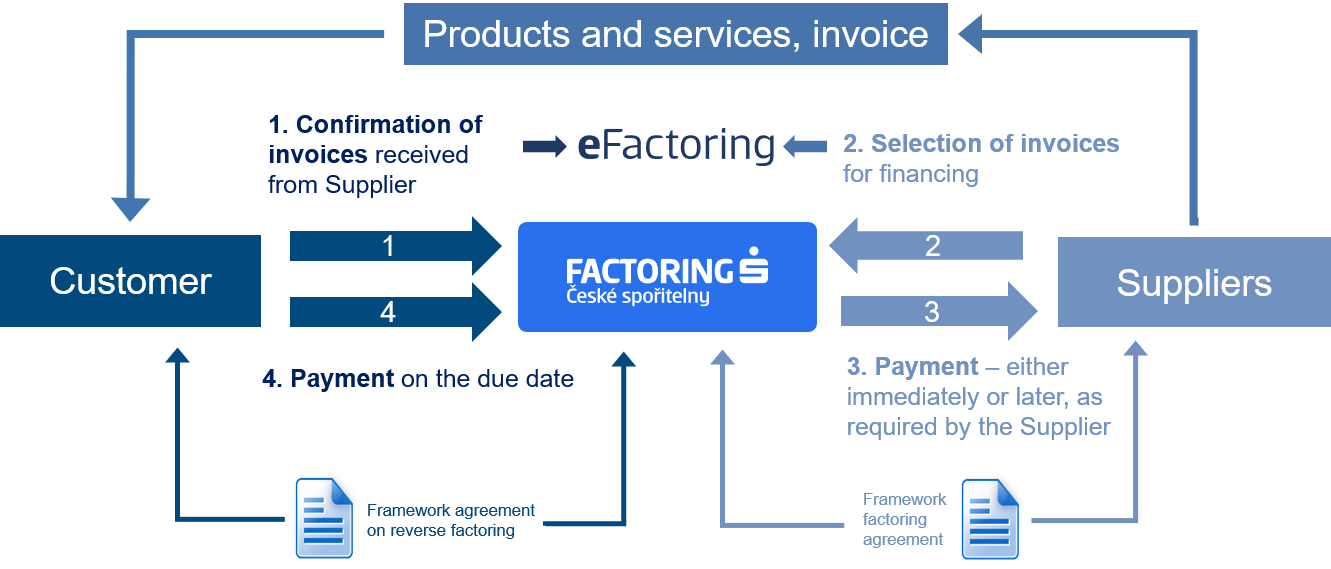

Use a solution for the financing of your suppliers that is based on a confirmation of your commitments! All this may be done electronically via the eFactoring Internet platform, with the support of EDI, electronic document interchange that has been made possible due to our partnership with EDITEL, a leading international provider of electronic document interchange services.

What is reverse factoring?

- A simply controlled, fully automatic tool for up to 100% financing of your suppliers on the basis of a confirmation of your business commitments

- Your working capital is optimised thanks to an extension of the due dates of your suppliers’ invoices

- Obtain extra sources of financing without increasing your credit engagement

Reverse factoring is a method used in the financing of customer-supplier relations (Supply Chain Finance) that supports business cooperation between companies of varying sizes and financial strength. Whereas in standard factoring, the client is the supplier who assigns his receivables from multiple customers and obtains immediate payment on its invoices, in the case of reverse factoring, the client is one large solvent customer who has a larger number of smaller suppliers.

What will reverse factoring bring you?

- Better utilisation of your working capital thanks to an extension of the due dates of your suppliers’ invoices

- The possibility to ask your suppliers to extend their due dates without an adverse impact on their financial situation

- Securing extra sources of financing without increasing your credit engagement with banks

- The possibility of using reverse factoring in negotiating more favourable prices from your suppliers

- No minimum or maximum limit on the amount of supplier invoices for financing

- Stabilisation of your supplier portfolio

A win-win solution

Together, we will select and approach your suppliers with an offer of factoring financing for up to 100% of their receivables from your company, without an adverse impact on their financial situation – subject to pricing conditions based on your company’s creditworthiness. On this occasion, you can request an extension of the due dates of their invoices or other conditions governing your business relations. This will allow you to yet better optimise your cash flows and to move working capital from short-term assets to the development of your company. And with reverse factoring, your suppliers can secure a more stable position within your supplier portfolio.

How does reverse factoring work?

Take advantage of reverse factoring, a modern method for the financing of the customer-supplier chain (Supply Chain Finance) and cooperate with Factoring České spořitelny, a major player on the Czech factoring market.

Please contact us to request a customised offer.